Period RSI Forex Indicator

Period RSI Forex Indicator

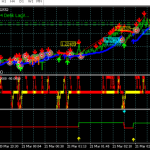

As any other oscillator, the RSI indicator is not plotted on the price chart, but in a separate window below. This technical instrument consists of a single line and two levels set by default. Vertical axis range of the indicator is set to 1 to 100 showing extremality of current price against its previous values.

RSI calculation

RSI = 100 – (100 / (1 + U/D))

Where:

U – average number of positive price changes

D – average number of negative price changes

What the formula means, is that if the price grows against previous values, so does indicator reading; otherwise, oscillator’s value goes down. The RSI line may reach 0 or 100 only during strong, continuous downward or upward trend, respectively.

Usually standard overbought and oversold levels are 70 and 30. If the indicator’s line goes above the 70 level, it signals that market is overbought and the trend may reverse downwards. If the indicator’s line goes below the level 30, it signifies that market is oversold and the trend may reverse upwards. The reference level is 50, and it is the median value. If the indicator chart is ranging between the levels 30 and 70, the market is flat or that the current trend is smooth, steady and there is less of a likelihood for reversal in short-term. Sometimes, overbought and oversold levels are set at 80 and 20 instead of 70 and 30. This setting is used during increased market volatility.

RSI Trendlines

Contrary to popular belief, the Relative Strength Index (RSI) is a leading indicator. This quality can be observed by using trendlines on the RSI chart and trading its break. When the RSI is rising, an upward trendline is drawn by connecting two or more lows and projecting the line into the future. Similarly, when the RSI is falling, a downward trendline is drawn by connecting two or more highs and projecting the line into the future. A break of an RSI trendline precedes an actual price reversal or continuation in the market. For instance, if the asset price breaks above a downward trendline, it is a signal that the price is about to edge upwards, either as a continuation of an uptrend or as a reversal of an existing downtrend in the market.

Period RSI Forex Indicator download link