Gurumarra Forex forex robot

Whats up All,

I’ve determined to publish my EA right here for 2 causes:

1) I prefer it however am certain it could possibly be a lot better and need to get assist to enhance it

2) I used to be humbled by the way in which others (George) have freely shared their code, concepts, and most significantly their time, to help others.

So here is my again story…(briefly)

After blowing a number of thousand {dollars} over the previous few years I began trying by means of this website and got here throughout a couple of concepts and indicators I assumed value in additional element to see if I may make them work for me. Particularly I picked up some concepts/indicators from Alien, Jim Brown (JagFX), Jim Dandy (examine his Youtube channel) and Astorcoder – so kudos go to them…but in addition the various who contributed to their techniques as effectively.

I’ve discovered two main obstacles in my buying and selling – I’m in Japanese Australia (Sydney) so am all the time asleep when the key markets are open, and I’m too emotional so are inclined to dive in too early, take fast small earnings and sit on losses.

My resolution (as an ex programmer) was to develop a robotic that will take the emotion out and commerce once I was asleep.

So I’ve developed a robotic which I’ve known as Gurumarra Forex (Gurumarra is an aboriginal phrase that means one thing like “electrical storm” or “dry lightning”) and I’m now sharing it.

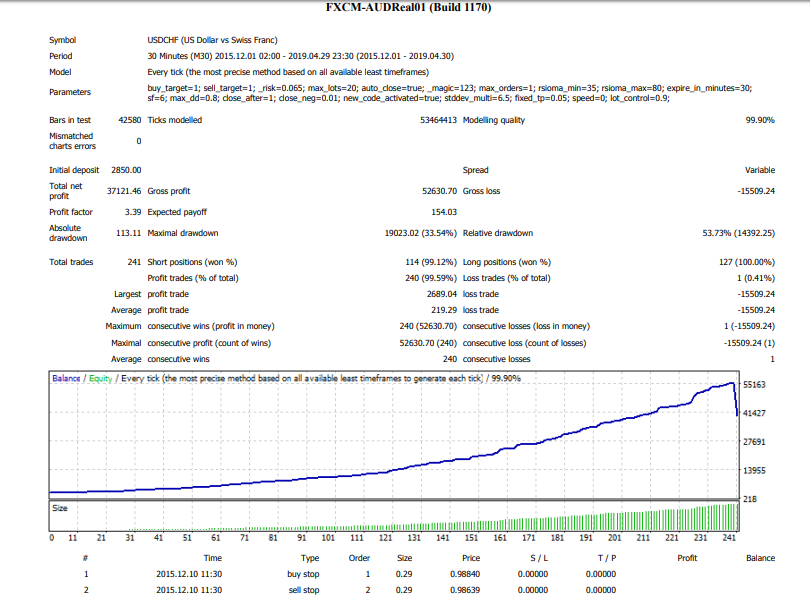

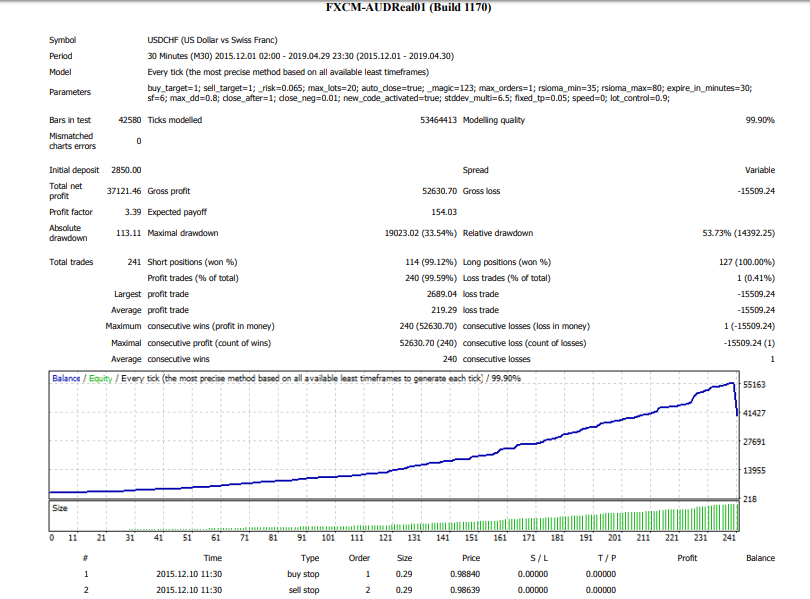

I’ve solely simply commenced operating it reside and have blended leads to my account on account of some bugs that weren’t recognized in again testing and which resulted in some losses. However here is a pattern take a look at end result connected.

Some feedback and explanations:

I’ve tried the EA out on a number of time frames however am concentrating on M30 charts – having stated that I get comparable outcomes on H1 and H4 as effectively.

The EA does NOT work on each pair – a lot of my testing has been to determine these pairs that appear to supply one of the best end result.

I’m glad to take a big DD as long as I will be assured that the worth will come again to revenue so I do NOT use stops however do management most DD by way of a parameter.

I would like the earnings to run however don’t know the place to set the TP so have included numerous choices for the exit as you will note within the parameters and within the code. I don’t know what number of pips or $ to set as a goal so have determined to set the goal as a % of the account steadiness.

So far as the exit is anxious I’ve famous {that a} flip of the OsMA works effectively at getting out with a revenue so I exploit a smoothed common worth of this indicator to exit (if the goal % has not but been reached) and the PA (value motion) is popping the mistaken manner.

With all the indications on the earth I reckon you continue to cannot predict which manner the PA will go so the EA locations a straddle on the set off bar after which waits for it to be triggered.

I’ve not massaged the code to make it fairly however no apologies – take it or go away it as you’ll – however enhancements are welcome (see above).

Indicators used:

RSIOMA

QMP Filter

QQE Advisor

MACD Platinum

OsMA

Within the subsequent publish I’ll clarify the parameters and supply the indications required – OSMA needs to be in your fundamental MT4 bundle however the others are ALL required and out there elsewhere on this website as effectively. The QMP Filter, QQE Advisor and MACD Platinum are because of Jim Brown who makes use of them in his buying and selling technique and is glad to share them – they’re basically the “set off” for the commerce. The RSIOMA is used as a filter to weed out the trades which can be at excessive values (really considerably reverse to Jim’s strategy). Observe that the indications aren’t required on the chart however they’re wanted within the setting.

UPDATE – Observe that this EA makes use of bar open to manage exit/entry nonetheless testing ought to nonetheless be carried out on each tick

UPDATE – Newest model of the EA is now connected to this publish #1. Code has been cleaned up considerably and a few minor modifications in message dealing with/descriptions and the time restrict for Friday buying and selling – now set to stop buying and selling on Friday after 12 midday – you could need to configure to your native time zone.

UPDATE/CORRECTION to publish #5

The worth for STDDEV for preliminary testing runs needs to be 99999. My unhealthy. Testing this for values between 1-10 needs to be executed after the RSIOMA, Threat and different parameters have been tuned.

As I stated within the first publish the code is scrappy so there are some inconsistencies in the way in which the parameter values are configured.

Purchase Goal/Promote Goal

These had been initially developed as a single worth however I quickly realised that the power to set them individually supplied a extra “fine-tuned” strategy. This parameter has a price between 0 and 1. It is a share of the account steadiness so an instance: when you’ve got a $1000 steadiness and enter 0.10 then the goal revenue is 10% of your account steadiness or $100. A price of 1 means you might be on the lookout for a 100% ($1000) revenue as your goal.

Threat %

That is the % of your account free margin you might be keen to danger. Relying on the pair i’ve discovered values between 2% and 7% are the utmost – above that the DD (draw down) rapidly will increase to very massive ranges.

Max Heaps

The utmost lot measurement you’re ready to run at – my dealer has a restrict of 20 tons however others could have smaller or larger lot measurement limits

Auto Shut

True – the EA will mechanically shut trades if the exit circumstances are met – advisable

False – the EA will ship a message to your electronic mail and MT4 {that a} shut situation has been met however will NOT shut the place

Magic

Ought to be self explanatory

Max Orders

The utmost variety of lively orders for this magic quantity (I like to recommend leaving at 1)

RSIOMA Min/Max

The minimal and most values that the RSIOMA indicator have to be earlier than a commerce shall be triggered. This needs to be examined and set for every pair, for every timeframe and every dealer the EA is operating on. This may increasingly want adjustment over time because the market modifications so be ready to conduct affirmation testing on a month-to-month foundation.

Expire in Minutes

As famous the EA locations Restrict orders as a straddle on the set off bar. This parameter units the variety of minutes after which the orders will expire.

Smoothing Issue

That is the smoothing issue for the OsMA – typically a price of 6 durations appears to work however this too must be examined for every pair/tf

Most DD (drawdown)

That is the management for catastrophic SL (cease loss). In testing and selecting the right performing pairs I set this to a price of 0.6 (60%). The code will shut an order if the DD goes above this worth. You must set this based mostly in your intestinal fortitude however decrease values result in a whole lot of cease outs.

Shut After / Shut Unfavourable

These parameters work collectively to manage the period of time {that a} place shall be detrimental earlier than a theoretical SL will shut the place. So for instance in case you set these as 1 / 0.01 the EA will shut the place if (a) the place is greater than 1 hour previous; AND (b) the utmost loss is lower than 1% of the account steadiness. Play with these to see what works greatest. In my preliminary testing I all the time set the time to 999999 and go away the % at 0.01 that means it would by no means set off. I solely tune this after different fundamental parms (Threat, RSIOMA) have been set.

New Code Activated

That is for testing new code in order that I can decide the affect. As soon as glad that the brand new code is OK and embedded within the EA this may be turned off – for the coders on the market this may be helpful. For this primary model go away it as “true” as I’ve not but carried out the clean-up and the code is operating OK.

STDDEV Multi

That is basically experimental – I discovered that always the OsMA would point out an exit effectively away from a greater revenue. By calculating a regular deviation I’ve improved the profitability by setting this parameter such that if the revenue was ‘x’ customary deviations away from the median then the EA would shut the place and seize the revenue – a greater manner could be to shut a part of the place (say 50%) at this level and go away the remainder on the desk. Any options right here very welcome.

Mounted TP

That is one other “experimental” parameter and I’ll take away it at some stage. Mainly it says that if the revenue has reached this worth as a % of the account then take a revenue it doesn’t matter what the opposite revenue setting parameters are set at. On the face of it this might appear to be interfering with the opposite parameter settings but I’ve discovered that it appears to enhance profitability. One other parameter that must be examined.

Velocity

That is strictly for controlling the visible again take a look at pace (thanks Jim Dandy)

Lot Management

The lot measurement algorithm calculates the order measurement based mostly on margin, danger and price. This allows the person to additional fine-tune the lot measurement (and in the end the DD and revenue) by decreasing (or I suppose rising) it by multiplying the bottom lot measurement by this worth – so for instance say the algo calculates so much measurement of 2 and this parm is ready to 0.9 then the precise order measurement shall be 1.8 tons.