TMA-ADR Reversal Trading and BBMA FOREX

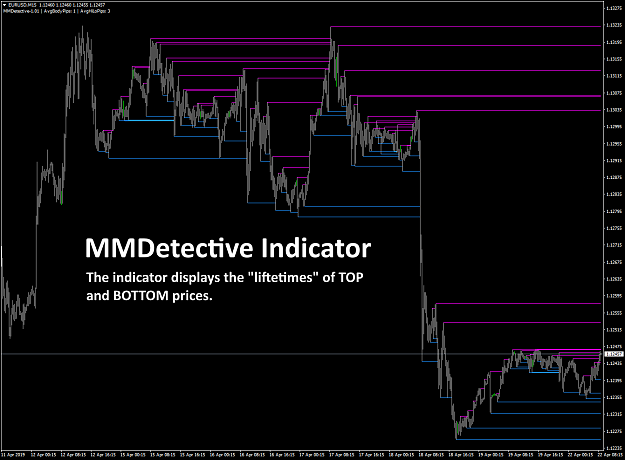

Wanting on the worth chart from left-to-right, the purple traces start at a TOP and prolong to the precise till they’re “taken-out” or eliminated by the worth transferring upward. Equally, the blue traces start at a BOTTOM and prolong to the precise till they’re “taken-out” by the worth transferring downward. Utilizing this indicator you may clearly see the “lifetimes” of TOPS and BOTTOMS.

A TOP happens when the worth strikes downward. A BOTTOM happens when the worth strikes upward. Cease Losses accumulate above and under the worth line. Within the case of Quick trades (promoting), Cease Losses accumulate above the worth line, and within the case of Lengthy trades (shopping for), Cease Losses accumulate under the worth line. When the MM initiates a spike upward, Cease Losses from Quick trades are taken-out. When the MM initiates a spike downward, Cease Losses from Lengthy trades are taken out.

The sample of ranging or trending costs adopted by a spike happen over and over once more — each image and timeframe. Moreover the size of the spike could be very precise — simply lengthy sufficient to take-out the focused Cease Losses — no extra and no much less.

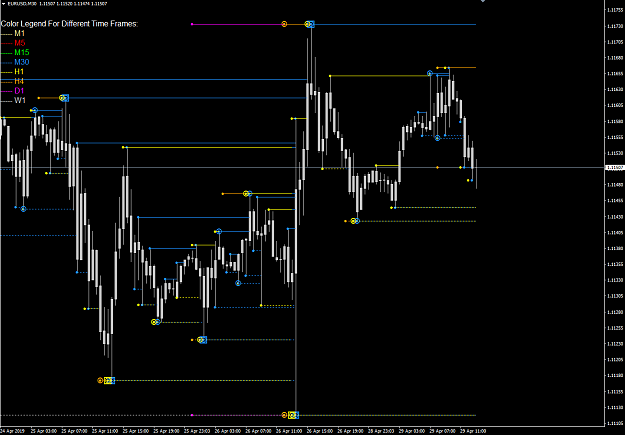

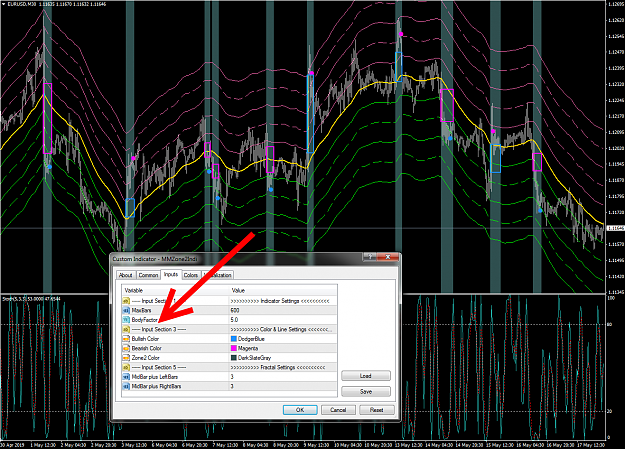

MM Detective MTF-HLF Indicator (‘MTF’ refers to multi-time body, ‘HLF’ refers to higer-level fractals).

This model consists of help for each MTF (a number of time frames) and HLF (higher-level fractals). MTF had at all times been within the works, however HLF was not. It was lately launched to me by @SwingMan — so he deserves all of the credit score. My sense is higher-level fractals do a greater job detecting TOPS and BOTTOMS — we’ll see.

MM Liquidity Gaps Indicator

Liquidity gaps — additionally known as “hidden” gaps — replicate unfilled (untransacted) BUY or SELL orders. My working speculation, till somebody comes up with one thing higher, is the MM needs to transact these orders. Moreover, the one technique to earn a living in foreign exchange is for costs to maneuver vertically up and down, and as a way to transfer up and down there have to be liquidity. Whether or not the MM manipulates costs to maintain liquidity fluid or whether or not it manipulates costs to forestall world-wide commerce from shutting down, I do not know. Regardless, liquidity is significant.

Since there are a set variety of items of every foreign money then each BUY have to be matched by a SELL. Suppose a big BUY order is available in at a sure worth, however there are not any items of that foreign money out there at that worth. The MM has to shake the tree a bit to reap some items to fulfill the BUY order. That is the place the manipulation comes into play while you see how goal ranges are created to lure merchants in a single path or the opposite — the objective being to shut them out, free-up items of foreign money, and present liquidity essential to transact unfulfilled orders. I do not know for certain whether or not that is the way it all works — however for now it offers a context for me to clarify MM psychology.

From @George I’ve discovered about two varieties of targets:

(a) Goal ranges (created by TOPS and BOTTOMS traces) which are created by the MM to lure merchants into pondering there are help or resistance ranges. The intent is to both encourage merchants to open a brand new place or regulate their cease loss (for later harvesting by the MM).

(b) Liquidity gaps — costs that have to be revisited as a result of unfilled orders stay to be transacted.

The MMDetective indicators had been created to assist determine the goal ranges created by TOPS and BOTTOMS traces.

The MMLiquidityGaps indicator was created to detect liquidity gaps which are sometimes laborious to detect by eye.

Liquidity gaps might be displayed as traces (which I favor) or as bins. Bullish liquidity gaps get stuffed when the MM pushes the worth down, whereas Bearish liquidity gaps get stuffed when the MM pushes the worth up. The rationale I favor traces is as a result of gaps usually are not essentially stuffed by a single worth motion — that’s, the MM could take a number of bites out of the hole and it’s simpler to see this with traces. The pictures under present a taste of what I imply:

MM Zone2 Indicator

MMZone2Indi might be fairly completely different than most others you’re accustomed to. It divides a worth chart into two zones — Zone #1 is the place the MM’s manipulation and purchase / promote / stoploss fest happens, and Zone #2 is the aftermath of a liquidity hole the place the MM has “proven its hand”. There is a crucial underlying assumption — liquidity gaps get stuffed a really excessive proportion of the time (like > 95%). If you happen to disagree with the assertion, then this indicator is NOT for you.

We have mentioned dividing a worth chart into two areas or zones. Zone #1 is the place many of the buying and selling happens and the place the MM performs its manipulations. There isn’t a cause to not commerce in Zone #1 — simply concentrate on the manipulation occurring. That is what we discovered from @George’s thread.

When requested for some steering on how one ought to commerce within the presence of all this manipulation, @moodybot supplied a clue — look ahead to the MM to indicate its hand. And that’s what led to the thought of a Zone #2. Zone #2 is the area instantly following a perturbation — the place the MM closed an accumulation of cease losses to generate liquidity. The perturbation comes within the type of a worth spike. A side-effect of the worth spike is {that a} liquidity hole is fashioned. I do not assume that’s essentially intentional — fairly, it’s the results of an surprising spike that skips over a variety of costs.

Within the fast aftermath of the perturbation the system is in an unstable state and the worth is out of whack. So, the MM most likely needs for the system to return to a “honest worth” state — i.e. re-establish an equilibrium between patrons and sellers. This small window — the place the MM most likely limits its manipulation — I am calling Zone #2.

There isn’t a “official” definition of the place Zone #2 begins and ends. That is strictly empirical. Nevertheless it’s attention-grabbing and introduces one more method to buying and selling. The MMZone2Indi indicator makes use of the fast aftermath of a liquidity hole to outline the beginning of a brand new Zone #2. That’s, Zone #2 begins at a newly fashioned liquidity hole. However the place does it finish? I cannot say for certain. Nonetheless, what I’ve performed right here is to make use of the primary 7-bar fractal to outline the top of a Zone #2. There’s nothing magical about utilizing a 7-bar fractal — I simply wanted one thing to behave as a fence publish between Zone #2 and the following Zone #1 as a result of the MM definitely doesn’t go away something behind that might function a boundary.

Listed below are some basic buying and selling guidelines — they don’t seem to be carved in stone and could change as we study extra:

- Outline Zone #2 — the place the LHS (left-hand facet) is a newly-formed liquidity hole and the RHS (right-hand facet) is a 7-bar fractal pointing in the identical path because the liquidity hole.

- Inside Zone #2 we wish to commerce in the other way of the LG (liquidity hole). That’s, after a bullish LG we wish to go SHORT, and after a bearish LG we wish to go LONG.

- Inside Zone #2, we’d like a filter / indicator / magic wizard to assist us determine the timing of a commerce. At present I’ve chosen to make use of the default Stochastic oscillator since offers each path and timing parts. When the Stoch crosses ’80’ downward then you definitely SELL, and when the Stoch crosses ’20’ upward then you definitely BUY. The coloured dots align with the Stoch crossing ’20’ upwards or the Stoch crossing ’80’ downwards.

This new concept of buying and selling from Zone #2 seems promising, however it isn’t good. Further guidelines / filters might be added to enhance accuracy.

One essential query nonetheless stays — when to Exit. In case you are grasping and wait too lengthy, then your successful commerce turns right into a loser. It seems like in case you are keen to simply accept small wins then positions that had been opened inside Zone #2 have a excessive win charge. Maybe even handed use of SL and TP will likely be adequate.

One other level — I actually like utilizing @Nih98’s TMA indicator and I’ve included it within the instance above. Although not required, it does present visible context so you may higher decide whether or not the present perturbation is powerful or weak, which could affect your choice to make a commerce inside the present Zone #2 or move.

By no means argue with a idiot. Onlookers could not be capable of inform the distinction.