Forex Scalp Retracement Trading System

Forex Scalp Retracement Trading System

Long Entry:

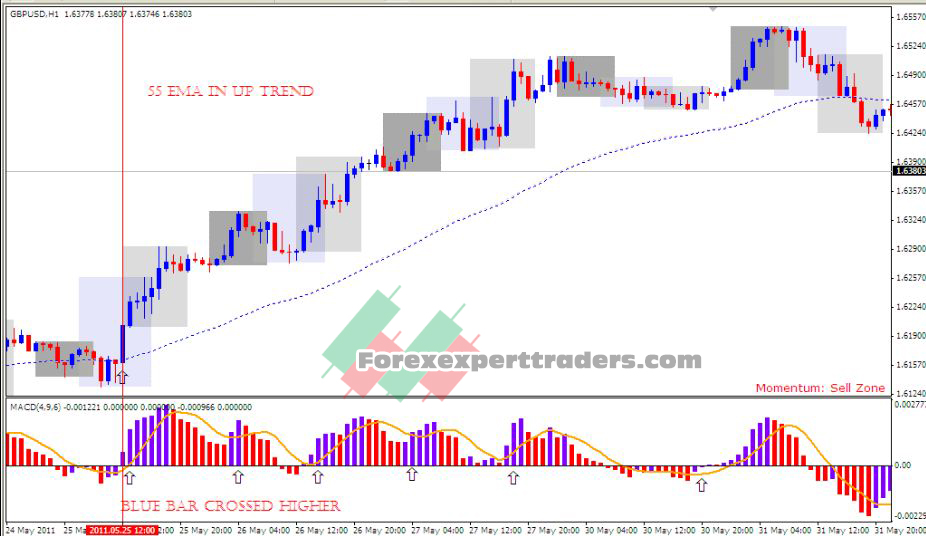

The Closing price must be above 55EMA on The Hourly Chart;

The closing hourly candelstick must be a bullish candelstick;

MACD bar mus show a positive divergence or show a higher low bar.

If all of the conditions above agree,

switch to a 5-min chart.

Scenario A: look out for 38% or 50% Fibonacci retracement (support) from the recent swing low on hourly chart. Open long position if the candelstick went below but closed above the retracement level (eigther 38% or 50 %); set stop loss at 61,8% or recent swing low if your risk per trade allows.

Scenario B: if the price action does not retrace to 38% level, open long position at the break of the previous hourly candle’s high; set stop loss at 61,8% or at recent swing low.

Short Entry:

The Closing price must be below 55EMA on The Hourly Chart;

The closing hourly candelstick must be a bearish candelstick;

MACD bar must cross lowe the Signal EMA on the hourly chart and color must be red.

If all of the conditions above agree,

switch to a 5-min chart.

Scenario A: look out for 38% or 50% Fibonacci retracement (resistance) from the recent swing high on hourly chart. Open short position if the candelstick went below but closed above the retracement level (eigther 38% or 50 %); set stop loss at 61,8% or recent swing high if your risk per trade allows.

Scenario B: if the price action does not retrace to 38% level, open short position at the break of the previous hourly candle’s low; set stop loss at 61,8% or at recent swing high.