SDTR a Profitable Forex Strategy Forex Trading

The primary thread was very profitable when it began in 2017, and likewise in 2018 with over 224 pages, 4463 posts, and over 1.3m views! We had many nice developments, and we discovered a lot.

As there have been so many posts, pages, and new developments to the technique, this new thread will function a continuation, additionally saving most lazy members from studying via the entire thread to be updated. SDTR a Profitable Forex Strategy

I’ll attempt to publish often as time permits me, and publish legitimate set ups based on the technique guidelines.

In 2018 an EA was developed which had preliminary success, however over a longer time frame, the dearth of human intervention and human instinct was its weak point, and it didn’t be worthwhile long run, nevertheless I’ve connected the newest model and set file which you’ll be able to take a look at on demo for those who like. I’d advise not permitting auto buying and selling with this model, and to solely use the EA for the alerts, after which verify first earlier than opening an order.

I’m nonetheless open to a different EA being created, I do imagine its potential for this technique to be automated efficiently, this will likely be a problem, however challenges are potential.

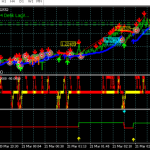

Okay right here is the technique guidelines! This technique relies off of buying and selling development reversals. It requires you to be very affected person, and calm as confirmed set ups are few, however when there may be a confirmed arrange it is going to be worthwhile more often than not. There are 4 fundamental indicators which might be used for this technique.

We are going to commerce primarily on H1 chart, though H4, and D1 time frames can be traded efficiently.

It is vitally essential to make it possible for all the indications are in settlement for a affirmation of a commerce, if not then it would cut back your likelihood of success.

Setting the SL & TP ranges is a private alternative. For me once I do set a SL, I’d usually set my SL on the earlier swing excessive or swing low (earlier ZigZag Arrow) and, examine the pivot ranges. I additionally pay shut consideration to cost motion. The TP can both be a mounted goal (+50-100 pips relying on timeframe traded) or utilizing Fibonacci retractment, ADR %, or when there may be a new confirmed reverse sign to get most pips. It’s also possible to set a trailing cease after a predetermined min quantity of pips made, after which transfer SL to BE and so forth. I’ll monitor the worth motion nearly all of the time, and get out if I see the development is altering, and a new reversal forming. Please see under the commerce guidelines:

Guidelines to purchase:

A inexperienced ZigZag Arrow will seem.

The Turbo JSRX indicator was/is within the oversold zone (Under the 30% stage) and indicating a inexperienced uptrend.

The value will hit and be inside the pivot stage zone (0-25 pips) ranges, S61, S78, S100.

When the candle crosses, and closes above the 10 EMA up from under, and provided that the commerce continues to be confirmed by the 3 indicators.

Guidelines to promote:

A pink ZigZag Arrow will seem.

The Turbo JSRX indicator was/is within the overbought zone (Above the 70% stage) and indicating a pink down development.

The value will hit and be inside the pivot stage zone (0-25 pips) ranges, R61, R78, R100.

When the candle crosses, and closes under the 10 EMA down from above, and provided that the commerce continues to be confirmed by the 3 indicators.

So solely when all 3 indicators have confirmed a legitimate commerce, and are all in 100% settlement with one another based on the foundations, and the candle crosses, and closes above or under the 10 EMA, an order is validated, and opened.

It is usually essential to watch value motion. Generally there will likely be a massive quick transfer with the present candle taking pictures via the EMA, in that case I’d not watch for the present candle to shut, and I’d enter immediately to catch the remainder of the transfer. Do that at your personal discretion!

This technique works, and I encourage all of you guys to do this technique and please share your outcomes with us. I do know that this technique could be very worthwhile for everybody. For now allow us to take pleasure in buying and selling, and accumulating extra pips from the market!

Please be well mannered and respectful to all members, and lets maintain the thread on subject! When you can’t observe these easy tips you can be eliminated. You probably have a good concept or proposal that may enhance on the technique publish it with a proof to validate your proposal.

Please subscribe to maintain up to date with all newest developments of this technique, give your suggestions, and lets all take pleasure in success from this technique. Inexperienced pips to you all, cheers! SDTR a Profitable Forex Strategy The primary thread was very profitable when it began in 2017, and likewise in 2018 with over 224 pages, 4463 posts, and over 1.3m views! We had many nice developments, and we discovered a lot.

As there have been so many posts, pages, and new developments to the technique, this new thread will function a continuation, additionally saving most lazy members from studying via the entire thread to be updated. SDTR a Profitable Forex Strategy

I’ll attempt to publish often as time permits me, and publish legitimate set ups based on the technique guidelines.

In 2018 an EA was developed which had preliminary success, however over a longer time frame, the dearth of human intervention and human instinct was its weak point, and it didn’t be worthwhile long run, nevertheless I’ve connected the newest model and set file which you’ll be able to take a look at on demo for those who like. I’d advise not permitting auto buying and selling with this model, and to solely use the EA for the alerts, after which verify first earlier than opening an order.

I’m nonetheless open to a different EA being created, I do imagine its potential for this technique to be automated efficiently, this will likely be a problem, however challenges are potential.

Okay right here is the technique guidelines! This technique relies off of buying and selling development reversals. It requires you to be very affected person, and calm as confirmed set ups are few, however when there may be a confirmed arrange it is going to be worthwhile more often than not. There are 4 fundamental indicators which might be used for this technique.

We are going to commerce primarily on H1 chart, though H4, and D1 time frames can be traded efficiently.

It is vitally essential to make it possible for all the indications are in settlement for a affirmation of a commerce, if not then it would cut back your likelihood of success.

Setting the SL & TP ranges is a private alternative. For me once I do set a SL, I’d usually set my SL on the earlier swing excessive or swing low (earlier ZigZag Arrow) and, examine the pivot ranges. I additionally pay shut consideration to cost motion. The TP can both be a mounted goal (+50-100 pips relying on timeframe traded) or utilizing Fibonacci retractment, ADR %, or when there may be a new confirmed reverse sign to get most pips. It’s also possible to set a trailing cease after a predetermined min quantity of pips made, after which transfer SL to BE and so forth. I’ll monitor the worth motion nearly all of the time, and get out if I see the development is altering, and a new reversal forming. Please see under the commerce guidelines:

Guidelines to purchase:

1.A inexperienced ZigZag Arrow will seem.

2.The Turbo JSRX indicator was/is within the oversold zone (Under the 30% stage) and indicating a inexperienced uptrend.

3.The value will hit and be inside the pivot stage zone (0-25 pips) ranges, S61, S78, S100.

4.When the candle crosses, and closes above the 10 EMA up from under, and provided that the commerce continues to be confirmed by the 3 indicators.

Guidelines to promote:

1.A pink ZigZag Arrow will seem.

2.The Turbo JSRX indicator was/is within the overbought zone (Above the 70% stage) and indicating a pink down development.

3.The value will hit and be inside the pivot stage zone (0-25 pips) ranges, R61, R78, R100.

4.When the candle crosses, and closes under the 10 EMA down from above, and provided that the commerce continues to be confirmed by the 3 indicators.

So solely when all 3 indicators have confirmed a legitimate commerce, and are all in 100% settlement with one another based on the foundations, and the candle crosses, and closes above or under the 10 EMA, an order is validated, and opened.

It is usually essential to watch value motion. Generally there will likely be a massive quick transfer with the present candle taking pictures via the EMA, in that case I’d not watch for the present candle to shut, and I’d enter immediately to catch the remainder of the transfer. Do that at your personal discretion!

This technique works, and I encourage all of you guys to do this technique and please share your outcomes with us. I do know that this technique could be very worthwhile for everybody. For now allow us to take pleasure in buying and selling, and accumulating extra pips from the market!

Please be well mannered and respectful to all members, and lets maintain the thread on subject! When you can’t observe these easy tips you can be eliminated. You probably have a good concept or proposal that may enhance on the technique publish it with a proof to validate your proposal.

Please subscribe to maintain up to date with all newest developments of this technique, give your suggestions, and lets all take pleasure in success from this technique. Inexperienced pips to you all,