ELIOT WAVE

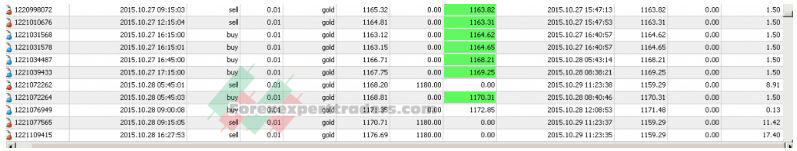

Why do I give a plus as a result of ELIOT WAVE combines a number of indicators that I’ve sucked on this discussion board with boards on the market: D I solely use the elliot wave technique. for buying and selling gold TF H 1 appears proper. I simply tried yesterday

Irrespective of how the development usually, the mixture of which signifies reversal candlestick formation with a bounce on the extent of assist/ resistance after the motion in a single path, it often leads to a substantial value actions, no less than till assist / subsequent resistance is created. The bigger the timeframe diginakan, the motion produced the higher. Right here I recommend H1/H4

Gold traded in a day by day vary may be very broad. Between 300-500 pips day by day vary is kind of frequent, and the common minimal day by day motion is 160 pips. Gold value volatility may be very excessive. Gold may transfer 80-100 pips in a matter of minutes, and a giant reversal was frequent

Gold may be very respectful of assist/ resistance. It is among the nice characters of gold. Technically, this character permits gold to traded precisely and constantly. Pivot, Fibonacci, additionally assist / resistance and trendline. you merely reap the benefits of 100-500 pips