Asian Breakout Trading System

Asian Breakout Trading System

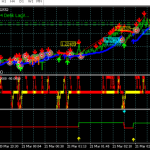

The bedrock of the AHAL strategy is identifying the highest (Asian High) and the lowest (Asian Low) price points during the Asian trading session. To do this, traders chart lines marking the extreme price points between 21:00 GMT and 06:00 GMT, the standard time frame for the Asian trading session. By 06:00 GMT, traders can conclusively establish the Asian High and Low of the day.

The breakout trading system is built around the anticipation that the price of an asset will move significantly in either direction, especially after being confined within a relatively narrow price range. The AHAL method sits squarely within this system, utilizing the High and Low of the Asian session to predict potential breakouts during subsequent trading sessions.

Once the Asian High and Low are identified, traders can use these points to mark potential breakouts during the European or American trading sessions. The underlying presumption here is that significant price movements are likely to occur once the price of an asset moves beyond the High or falls below the Low established during the Asian session.

Setup for Entry and Exit

- Work best on GBPUSD. It also works on all other pairs, but try it out with different SL and TP.

- Use 55 EMA to spot high-probability trades, thus avoiding entering any positions against the trend. Identify the trend using the EMA on the hourly chart, then switch to M5 TimeFrame to enter either buy at the Asian High or sell order at Asian Low.

- You must adjust trading session times to match your broker server time in the input parameters. Default settings are for GMT 2+. (which is the default on most brokers)

- Dark Gray Box – the Asian session

- Medium Gray Box – the European Session

- Light Gray Box – the America session

Buy Entry

- 55 EMA on the hourly chart is in uptrend mode. (EMA is blue with price above the EMA)

- Place a pending buy order at the Asian High.

- Set the stop-loss 30 pips below the Asian High.

- Set the first targeted profit at 15 pips.

- Set the second target profit at the next mid-pivot price level or the next pivot point.

- Auto Pivot Points Indicator MT4/MT5 FREE Download

- Move the stop-loss to break even after the first target profit is hit.

- Exit the second trade if an M5 candle close lower than the nearest pivot point.

Sell Entry

- 55 EMA on the hourly chart is in downtrend mode. (H1 EMA is red with price below the EMA)

- Place a pending sell order at the Asian low.

- Set the stop-loss 30 pips above the Asian low.

- Set the first targeted profit at 15 pips.

- Set the second target profit at the next mid-pivot price level or the next pivot point.

- Move the stop-loss to break even after the first target profit is hit.

- Exit the second trade if an M5 candle close higher than the nearest pivot point.

Asian Breakout Trading System download link