Generic Breakout V5

The EA ought to dynamically outline the breakout vary….primarily based on worth buying and selling inside a spread for a sure timeframe.

Say the M15 candle excessive and low establishes a spread and for the subsequent 4 or 5 candles it stays inside that vary, the variety of candles may very well be a variable you set….effectively, that is the vary for the breakout.

So it seems to say M15, M30 or H1 for such a worth motion after which trades the breakout of this dynamically created vary, primarily based on a set off just like the pattern on a much bigger timeframe….or possibly the slope of a fast-paced common on the timeframe the place the vary is created.

On a smaller timeframe a spread is usually a pullback of a bigger timeframe pattern, so it typically is smart to look to the upper timeframe for a que of what to do.

The issue with setting a sure instances for the breakout vary is that day by day is a bit completely different….some days, the vary begins sooner than different days….and a few days, it is not ranging in any respect, it is trending or it is only a mess.

A breakout, by definition, is worth consolidating inside a excessive and low worth for an prolonged interval, after which it breaks out. In order that it what the EA must search for.

You may play a M5 vary breakout, M15, H1, H4, D….all can have these conditions the place worth trades inside a excessive and low for an prolonged interval after which breaks out. It is only a query of how massive rather a lot and your stops whenever you take the breakout on the actual timeframe.

If this makes any sense to you, I’ve some additional concepts.

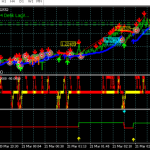

Right here is an instance…

EU, M15, 5 bars inside a brilliant bar….

and EU, day by day, 5 bars inside a brilliant bar (center chart)….

When worth strikes past the vary by X pips or a % of the vary, it opens a commerce….