Scalping with I-Regression Trading System

Scalping with I-Regression Trading System

Time Frame 5min or higher

Pairs:majors

Forex Indicators:

1) Linear Regression Channel (i-Regr) with the following settings: degree=3, kstd=1.5, bars=240, shift=0

2) Entry Trigger indicator with these settings: g_period_76=2, gi_80=1, Nbars=1000

3) Colored MACD with settings: FastEMA=5, SlowEMA=15, SignalSMA=1

LONG Entry:

1) Look for price to be near the Lower i-Regr band. If it is below or over the band that would be ideal. Sometimes we can open a position without this rule however the system is stronger when it is applied. As the lower i-Regr band represents a momentum support level, there is big chance that the price will retrace and if our other rules are also met, the chance for our trade to be profitable is greater. 2) Look for the MACD indicator to increase it’s value, in other words to be colored Green. If it occurs above the Zero line this is an even stronger signal however its not an absolute requirement.

3) Look for the Blue Arrow of the Entry Trigger to appear and then open a Long Position immediately. 4) Set your StopLossjust below the previous low. 5) Set your ProfitTarget at 15-30 pips from entry depending on the volatility of the pair you trade and the timeframe used. If the pair is more volatile, such as GBP/JPY, and/or the timeframe is higher, then you could set a larger takeprofit target. You can your close position manually as soon as you get 5-10 pips of profit if you feel that the price will reverse. It is better to close a trade in some profit rather than losing.

Long Trade Examples

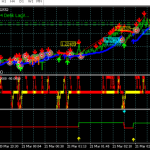

EXAMPLE 1: GBPJPY, M15

1) At point “A” we see that the price is was below and then moved over the lower i-Regr band and is heading up, meaning that the main trend is heading up. 2) At point “B” MACD is above the Zero line and is colored Green having increasing it’s value. 3) At point “C” the Entry Trigger Blue Arrow appeared giving a long signal and so we open a Long position at 135.47. 4) You could set a StopLoss just above the previous low at 135.19. 5) The TakeProfit Target was set 30 pips up at 135.77, where I closed this trade, because I consider the GPBJPY as a volatile pair

SHORT Entry:

1) Look for price to be near Upper i-Regr band. If it is above or over the band that would be ideal .Sometimes we can open position without this rule however the system is stronger when it is applied. As the upper i-Regr band represents a momentum resistance level, there is big chance that the price will retrace and if our other rules are also met, the chance for our trade to be profitable is greater.

2) Look for the MACD indicator to decrease its value, in other words to be colored Red. If its occurs below the Zero line this is an even stronger signal however its not an absolute requirement

3) Look for the Yellow Arrow of the Entry Trigger to appear and then open a Short Position immediately.

Set your StopLoss just above previous high. 5) Set your ProfitTarget at 15-30 pips from entry depending on the volatility of the pair you trade and the timeframe used. If the pair is more volatile, such as EUR/JPY, and/or the timeframe is higher, then you could set a larger takeprofit target. You can your close position manually as soon as you get 5-10 pips of profit if you feel that the price will reverse. It is better to close a trade in some profit rather than losing.