Quantum London Trading Forex

Good day gang, it has been a number of years since I posted final and have come again to get within the swing of issues once more. I had been out with a number of extreme private well being points and in addition some household points and haven’t been in a position to deal with my buying and selling, amongst different issues. I hope to go over some older threads and making an attempt to reply questions, so please don’t be offended or really feel disrespected if I don’t reply pm’s or e-mails instantly.

First issues first, a number of the issues I’ve discovered over the previous decade and techniques posted on listed below are most likely actually outdated have have most certainly run their course or have been modified a lot you would not even inform the place it initially got here from. So let’s begin with one thing easy and recent.

Everyone knows that it is extremely straightforward to overload a chart with the most recent and biggest indicators making your chart look actually fairly, however in essence nugatory to commerce on. I’ve discovered to maintain it quite simple and let the basics of value motion and studying when the true buying and selling begins. We see tons of London breakouts on the boards and this one is designed with slightly twist. As an alternative of concentrating on the London open, we’re organising our buying and selling situation to take advantage of the flaw within the Frankfurt open. So right here is the Quantum London Trading Technique.

Set Up

To set this up, obtain the indicator and template beneath. I’m utilizing OctaFX, however be at liberty to make use of no matter dealer you want. OctaFX is GMT+2, so be sure after we set this up your occasions are in sync. Open a 1 minute GBP/USD chart and cargo up the template. The template ought to have this saved on it but when not, place a vertical line on the chart at 5:00 am GMT (7:00 am on OctaFX).

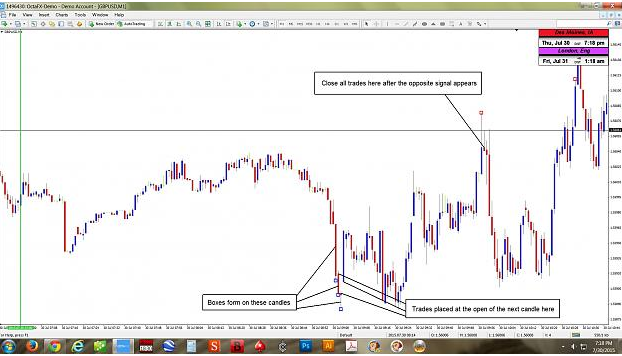

As you may see, now we have quite a few little bins on the chart protecting all occasions of the day. However we’re searching for one explicit vary of time right here. As we all know when the Tokyo opens and we see slightly motion there, then we going into slightly ranging interval more often than not after the brand new day begins at 00:00 GMT till the London open hits. However individuals neglect the the Frankfurt open normally give us slightly false sense of route earlier than the actual buying and selling route is set. The slowest quantity of the day is generally between 4-6:00 am GMT. Right here is our start line proper within the center at 5:00 am. We’ll ignore any bins shaped earlier than this time. Mainly what we’re seeing is an invisible ZigZag indicator in motion however when a brand new hello/low is reached the outdated field stays on the chart as a substitute of disappearing. That is what we’ll base our trades on.

Guidelines for entry

That is the straightforward half. We open a brand new commerce on the opening of the subsequent candle after a field seems, Blue bins for lengthy trades and Purple bins are quick trades. We proceed so as to add trades at every field that seems till we encounter an reverse coloured field during which all of the trades are closed without delay when the brand new candle opens. That is the robust half: RESTRAINT!!!!! Despite the fact that it might appear to be there are quite a few alternatives to re-enter different runs, do not! That is the place you will get caught in a brilliant future in the course of the London session solely to get caught within the ranging interval later within the day. Trading dimension can also be very essential as you’ll have 1 or 2 trades going or basket of 40+ or extra. This is how one can enter your trades (and it might be completely totally different for another person relying on their danger issue):

Trades 1-12=.01 Heaps

Trades 13-21=.02 Heaps

Trades 22-29=.05 Heaps

Trades 30-36=.13 Heaps

Trades 37-39=.34 Heaps

Commerce 40 =.89 Heaps

I’m solely utilizing 40 ranges as an instance for this technique. You may unfold it out with extra ranges with decrease tons to start with then ramp it up on the final 1/4 or so, no matter floats your boat. I’ve a basket calculation for 80 ranges that I exploit. However on this instance if we ever acquired as much as 40 trades, we might solely have a complete of 3.52 tons in play. However keep in mind, we’re going to be utilizing restraint right here and taking solely the prime first commerce of the session.

So now lets present what the setup appears to be like like utilizing at the moment’s chart within the subsequent submit. All outcomes posted don’t embody any spreads, slippage, commissions, or some other components affecting the whole variety of pips.