Pivot Points AiO indicator

Pivot Points AiO indicator

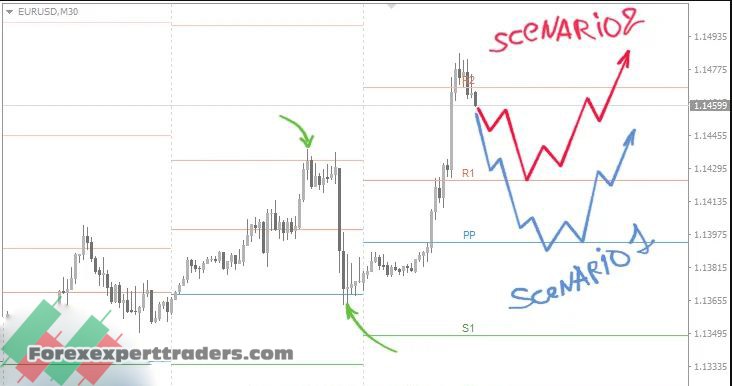

The Pivot Point Strategy In Forex Trading uses the most prominent calculation techniques to automatically generate crucial Pivot Levels in the MT4 terminal: Classical, Camarilla, Woodie, Fibonacci, and CPR.

For MT4, it’s arguably one of the greatest Pivot indicators. It’s also completely free and can be downloaded without having to register.

Category: Indicator

Platform: MT4

Currency Pair: All pairs

Trading Time: All sessions

⏳ Timeframe: All timeframe

⭐️ Grade: B / ★★★✩✩

Pivot Point Strategy In Forex Tradings has been based on the premise that the price is far more likely to reach yesterday’s closure point than to transcend the prior day’s range. As a result, the most often used computation period for Pivot Points is Daily.

All Pivot levels serve both support and resistance in this situation.

Calculation Modes and Formulas:

To calculate levels, HIGH (H), LOW (L), and CLOSE (C) data from the prior period, which is commonly a day, week, month, or hour, are employed.

The idea of RANGE (R) is also employed while computing Pivots.

The formula H-L is used to calculate its value.

PP – Pivot Point;

S1-S4 – Support levels;

R1-R4 – Resistance levels.

You should also take into account the distinctions between the Forex and stock markets.

Pivot levels were first utilized in the stock market, where the previous day’s closing price is extremely important and has a considerable impact on traders’ psychological behavior the following day. Forex, on the other hand, operates around the clock, thus the end of one trading day corresponds with the start of the next.

The Pivot Point Strategy In Forex Trading is formatted as an “All In One” indication. As we tried our best to incorporate all of the most common functionalities in this MT4 indicator, you may adjust it to your liking.

If you have any specific requests or suggestions for improvements, please contact us and we will gladly consider them.

Calculation Method – Choose from the following methods for calculating Pivot Points: Classical, Camarilla, Woodie, and Fibonacci. Each method’s formulae are explained above.

Calculation Period – It specifies the time frame during which the High, Low, and Close values will be calculated.

Available periods:Monthly.Weekly;Daily;Hourly;

Number of Periods to show. The number of preceding periods will be shown on the graph. If the option “Show only the current period” is selected, this parameter is ignored.

Show Only Recent Period. One or more computation periods are displayed.

Depth of Levels – The number of visible support and resistance lines on the chart is limited.

Right Shift – Continue the line to the right indent on the chart’s full length.

Color Scheme – The color scheme for the indication is automatically detected. It’s also possible to manually alter the backdrop color.

Pivot Points AiO indicator download link