Best Forex Trend Indicator V1.06

Best Forex Trend Indicator V1.06

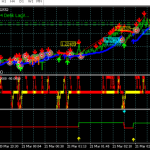

If you use trend lines frequently in your trade, the provided indicator will make it much easier to deal with them and eliminate the need to manually locate and draw the lines every time.

Only the most recent trend lines are shown in the indicator. If the line’s interaction with the price is no longer predicted, it will be deleted from the chart.

When fresh extremes occur, the Best Forex Trend Indicator does not redraw, but it might adjust the angle of the lines. It’s great for short-term and mid-term Forex trading.

System: AutoTrendLines v1.06

Category: Indicator

Platform: MT4

Currency Pair: All pairs

Trading Time: All sessions

⏳ Timeframe: All timeframe

⭐️ Grade: B / ★★★✩✩

Who is this indicator for?

Trend lines (TL) are a fundamental analytical tool that may be used with any indicator or trading strategy.

This Best Forex Trend Indicator will explain what a trend line is if you’re a beginner trader. Furthermore, by viewing the indicator in action, you will learn how to build trend lines on your own.

The approaches listed below will assist you in learning how to interpret trend lines and use them in practice.

For experienced traders, the Best Forex Trend Indicator will recommend trend line options and save time while setting them up.

Projection of the Trend

After you’ve installed the indicator, you’ll see that trend lines are divided into two types: solid and dotted lines.

The Best Forex Trend Indicator was able to determine a trend line, which is shown by the solid line.

The dotted line indicates the projected direction of trend continuance as well as the region of probable price-trend line interactions.

You’ve probably heard that trading with the trend is the most profitable strategy. This is due to the fact that the asset price tends to keep moving in the same direction as the trend, but a reversal is less likely.

Based on the rationale above, the next time the price reaches the trend line, it’s advisable to make a trade. You’ll also obtain the best reward-to-risk ratio if you combine this with a potentially winning trade.

As a result, the “Price bounce from TL” method implies:

When the price approaches or touches the uptrend line, buy;

when the price approaches or touches the downtrend line, sell.

All trend lines will eventually break. Traders, on the other hand, do not overlook the possibility to earn even in this situation. That is why a technique for trading when the trend line breaks out exists.

Conditions for entering the market:

If the price has stabilized above the downtrend line after it has been breached, you should consider purchasing if the price also reaches the line from the opposite side.

If the uptrend line has been broken and the price has settled below it, sell if the price meets the line again from the opposite side.

Both techniques use the same rationale when placing Stop Loss orders. Let’s look at the Buy trade as an example:

A stop-loss order should be set below the lowest price level within the trend line’s range.

The level of the highest price obtained at the moment of the trend line breakout should be used to place a Take Profit order.

In the same way, Sell deals may be analyzed using the opposing approach.

Best Forex Trend Indicator V1.06 download link