How to Calculate GAP Correlation 3 Pairs with Manual Backtest Forex

Hi there sensible dealer, Salam revenue with low DD, …

This time I’ll share how to backtest 3 pairs correlation, as a result of everyone knows that it’s not attainable to backtest 3 pairs utilizing MT4.

How to Calculate GAP Correlation 3 Pairs with Manual Backtest

What ought to we do to backtest?

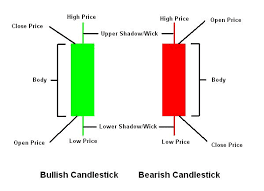

We agree that the Bullish candlestick is constructive (+) whereas the bearish candlestick is destructive (-)

How to Calculate GAP Correlation 3 Pairs with Manual Backtest

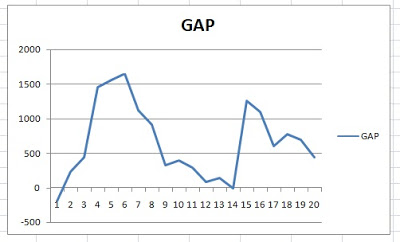

Suppose we’re going to open a promote purchase (BSB) that’s with a purchase pairA place promote pairB purchase pair C then we will calculate

GAP with the method GAP = A – B + C

now we’ll attempt to calculate the largest GAP for 3 pairs eur / usd, eur / jpy and usd / chf in March 2019. For the document, this GAP is calculated from March 1 to 29 so it isn’t simply GAP every day. I exploit TF Each day to calculate the high-low.

Now the image above is the largest GAP in March which is 1500 factors (150 pips) so like we open BSB on March 1, then across the eighth we will get a revenue of 1500 factors, quite the opposite if we open SBS on March 1 then we it can additionally float minus 1500 factors. With this evaluation, on March 8, the potential revenue that we will produce could be very massive, so if we open SBS on March 8, then when GAP returns to 0 we’ll get a revenue of 1500 factors as nicely.

Hopefully helpful

To simplify the evaluation please obtain Excel for calculations