Trading with range bars ichimoku cloud & awesome oscillator

This a primary put up on a brand new thread that’s an off shoot of massive revenue from a small account-m1 buying and selling system.

I’ll start posting my trades right here subsequent week.

Simply so each one know and understands i’ve no real interest in promoting any buying and selling methods, indicators or mirror buying and selling

companies.

This thread is solely for serving to one another with what generally is a very irritating passion/enterprise buying and selling.

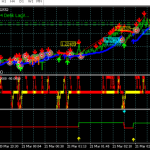

The system template is straightforward.

Candles, use i/2 min or range bars

indicators: Ichimoku cloud settings 9, 16, 52

awesome oscillator std. Settings

under is picture of what my charts appear to be:

Hey GW, the road on my chart is tenkan or extra precisely the tenkan sen or turning line it’s basically a shifting common the is computed by

utilizing the best excessive and lowest low over 9 bars, if you happen to evaluate it to 9 interval SMA you will note the tenkan exhibits extra areas of flattening. The flattening of the tenkan is indicative of worth ranging.

So far as staying in trades longer, I do not usually arrange tp orders forward of time, I take advantage of earlier s/r or swing highs/lows as targets if it breaks by way of I will keep in and see what occurs with subsequent goal. Additionally you need to use the tenkan under is an instance of use the tenkan flattening throughout

a commerce and utilizing it as s/r areas and ready for breaks which got here time after time.(clearly this doesn’t occur fairly often) however it does happen

extra usually on a smaller scale.

I used to be fortunate sufficient to get a LTF entry that I managed to commerce on a HTF chart.

I began of with a M1 commerce and it was operating properly. I had a revenue locked in, so I modified it as much as run on an H1 commerce.

It had the entire basic issues for an entry, break of the Kijun, worth under the cloud and a resistance space to the left that

worth moved by way of.

I’m not that good at discovering M1 entries that may be traded right into a HTF chart however the preliminary cease of solely 5 pips offers this a very nice RR ration.

That makes me assume that searching for an M1 commerce on the level the place an HI chart is establishing could be good to apply.