Trix Crossover Indicator

Trix Crossover Indicator

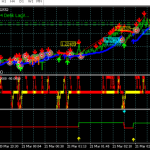

Trix Crossover Indicator is an MT4/MT5 indicator designed around the nearly classic technical analysis tool, Trix. As a triple exponential moving average Indicator (TEMA), the TRIX Indicator offers a unique advantage over traditional moving averages (MAs). Rather than appearing directly on a candlestick chart, the TRIX is an oscillator, with its line displayed in a separate window. This distinct presentation highlights the rate of change of the indicator through repeated fluctuations.

The TRIX offers traders an accurate and reliable perspective by relying solely on price data. The indicator does not repaint, making it an ideal choice for intraday trading and scalping in the Forex market. For optimal performance, traders should focus on timeframes between M1 and M30, ensuring efficient and effective market analysis.

How is the TEMA Indicator used in Forex Trading

TEMA can be used in forex trading in several ways. Here are a few examples:

Identifying Trends: TEMA Indicator can be used to identify the direction of a trend. When the TEMA rises, it indicates a bullish trend, while a falling TEMA indicates a bearish trend. Forex traders can use this information to enter trades in the direction of the trend.

Trading Signals: TEMA can generate trading signals when it crosses over or under the price. For example, when the TEMA crosses above the price, it is a bullish signal, indicating that traders should consider entering a long position. Conversely, when the TEMA crosses below the price, it is a bearish signal, indicating that traders should consider entering a short position.

Confirmation: TEMA can be used to confirm other technical indicators. For example, if a forex trader uses a stochastic oscillator to identify overbought or oversold conditions, they can use the TEMA to confirm these signals. If the stochastic oscillator generates a buy signal, but the TEMA is still falling, it may indicate that the overall trend is still bearish, and the trader should be cautious.

Stop Losses: Forex traders can also use TEMA to set stop-loss orders. If the TEMA rises, traders can place their stop-loss orders below the TEMA to protect their profits. Conversely, if the TEMA falls, traders can set their stop-loss orders above the TEMA to limit their losses.

It is important to note that Trix Indicator, like any other technical indicator, is not foolproof and can generate false signals. Therefore, forex traders should use TEMA in conjunction with other forms of analysis and carefully manage their risks.

Crossover of the Trix and the signal line

When the Trix line resides above the zero line, it indicates an overbought condition; inversely, when the Trix is beneath the zero line, it suggests an oversold situation.

To accurately identify the reversal timing, the crossover of the Trix and the signal line should be observed:

- A Buy signal emerges when the signal line surpasses the Trix.

- A Sell signal arises when the signal line falls below the Trix.

It is advisable to close a trade without waiting for a counter signal. You can establish a fixed Take Profit size or exit the trade when the Trix line, for instance, intersects the zero line.

In such cases, the zero line signifies the end of the reversal momentum, making way for the upcoming trend phase. Consequently, if the trend’s direction is unclear, it is preferable to exit the trade.

Crossover of the Trix and the zero line

The given type of signal by the Triple Exponential Moving Average Indicator is more suited to trend trading.

The signal is usually generated when the price leaves the flat zone, and there is a chance of the beginning of a new trend:

- The Trix is above the zero line – Buy.

- The Trix is below the zero line – Sell.

As in the previous case, a trade should be closed without waiting for the momentum to fade and the opposite signal to occur.

Both lines move in the same direction

In this instance, the focus is on identifying the concurrence of long-term and short-term trends.

The rationale is straightforward and mirrors the widely-referenced “Elder’s Triple Screen” strategy: a trend is more likely to persist if signals align across various timeframes (time periods).

A signal arises when the Trix and the signal line travel in the same direction:

- When both lines ascend – a Buy signal is generated.

- When both lines descend – a Sell signal is produced.

This method effectively pinpoints exit points. As demonstrated in the image, the indicator timely switched to a neutral signal, aligning with the price reversal.

Therefore, a trade should be closed when the lines lose synchronization and begin moving in opposing directions.

Trix Crossover Indicator download link