The Bollinger Squeeze (TBS) Strategy forex

Howdy everybody, it provides me nice pleasure to introduce The Bollinger Squeeze Strategy (TBS) to you.

I’ve seen among the indicators we’re going to use for this technique used elsewhere for buying and selling. Nonetheless, it is a complete bundle, which might be an excellent instrument in relation to worthwhile monetary market buying and selling.

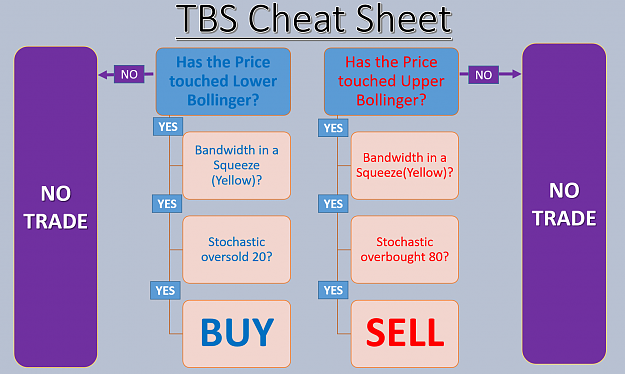

This Strategy is derived from the data of three indicators. Bollinger band, Bollinger Bandwidth and the Stochastic oscillator. The three indicators should all affirm our commerce sign. So to have a legitimate sign, three circumstances should be met.

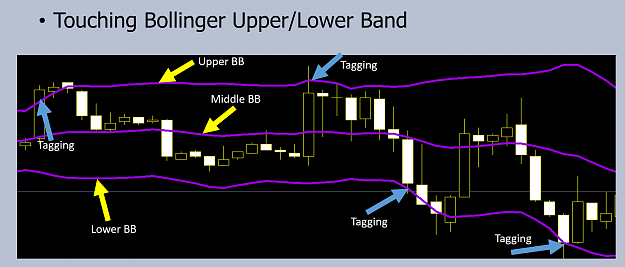

Condtion 1: Touching Higher/Decrease Bollinger Band

When costs reaches a excessive degree they are going to contact the higher band. When costs reaches decrease ranges, they are going to contact the decrease band. So to have a legitimate commerce, costs should contact both the higher or decrease band.

The Bollinger Squeeze (TBS) Strategy

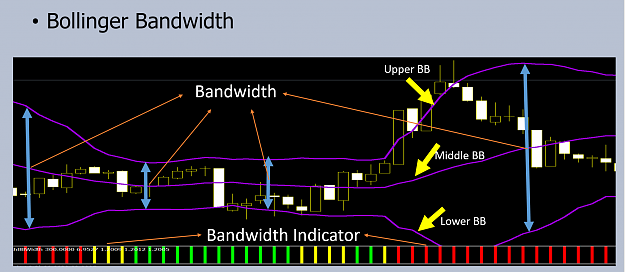

Situation 2: Bollinger Bandwidth measured by the Bandwidth Indicator

The bandwidth is the distinction (hole) between the higher band and the decrease band.

This Bandwidth indicator takes the present Width of the Bollinger Bands and compares it to the Most and Minimal Width of the Bands over N durations

If the calculated share is lower than or equal to X P.c (which we are going to specify), then the histogram reveals yellow. If the calculated share is larger than the X P.c, then the histogram reveals Purple.

This works out properly to rapidly see if the foreign money pair is ranging (Yellow) and if it has damaged out of vary (Purple)

To have a legitimate commerce, the bandwidth indicator should be Yellow which implies costs are contained inside a decent vary. This give us the chance to have the ability to commerce contained in the band choosing prime and backside of the vary with the assistance of the Stochastic indicator.

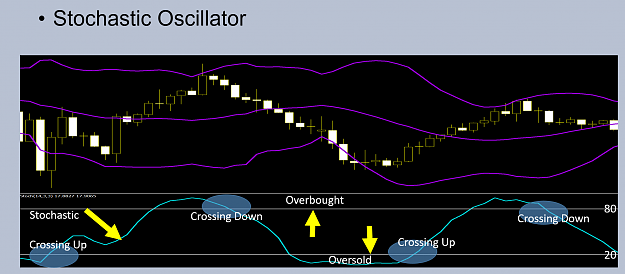

Situation 3: Stochastic Oscillator

Stochastic indicator normally has two horizontal traces, one at 20 and one at 80. The 20 line is named the oversold degree and the 80 line is known as overbought degree. To have a legitimate BUY sign, stochastic should have been within the oversold territory and crossing the 20 line upward. To have a legitimate SELL sign, Stochastic should have been within the overbought territory and crossing the 80 line downward.

Placing it collectively For a BUY Sign

As soon as value has contact the decrease band, you’ll test the Bandwidth indicator. The Bandwidth indicator should reveals that the value is in a variety (Yellow Color), You’ll then await Stochastic to substantiate the commerce. Stochastic indicator should cross the 20 line upward from the oversold territory.

Placing it collectively For a SELL Sign

As soon as costs has contact the higher band, you’ll test the Bandwidth indicator. The Bandwidth indicator should reveals that the value is in a variety (Yellow Color), You’ll then await Stochastic to substantiate the commerce. Stochastic indicator should cross the 80 line downward from the overbought territory.

The three indicators required are Bollinger Band (Included in Metatrader), Bollinger Bandwith (customized indicator, connected), and Stochastic Oscillator (Included in Metatrader). Listed below are the settings:

Bollinger Band

Interval – 20 , Shift – 0, Deviation – 2, Set to ‘shut’

Bollinger Bandwidth

Interval – 20 , Shift – 0, Deviation – 2, Width Calculation Interval – 100

Min Vary P.c – 20

Stochastic

%Ok interval – 9, discover it under:

%D interval – 3

Slowing – 3

Worth discipline – Low/Excessive

MA methodology – easy

The Bandwidth indicator and the template connected.