Support and Resistance Method – Pharley forex

This technique is beneath within the first few posts, or in a nutshell at Publish 185 on Web page 10.

Stay trades taken with results of +60% account progress in 1 commerce run begins at Publish quantity 176 on web page 9.

- Weekly candle chart – Attract areas/traces of SR:

2. Every day chart (similar time interval) – transfer to every day candle chart and watch candle value motion and SR space – pin bar at assist shaped:

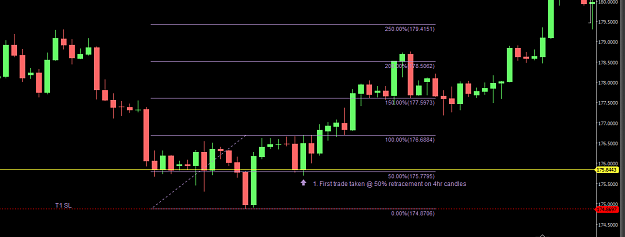

3.Arrange goal space – I take advantage of a modified Fib only for measuring. I take 90% of the earlier transfer because the goal:

4) 4hr entries – I transfer to 4hr candle and search for my first entry. This one is a 50% retracement entry. All targets for a number of trades at at my goal stage (see 3 above):

5) Second entry – on the 4hr candles. I wait till the primary 4hr candle closes above yesterdays excessive. SL from commerce 1 is transfer as much as the place SL for T2 can be:

6) I hold coming into on 50% retracements and both a 4hr candle closing above yesterday excessive, or wait till a break above the excessive comes again to retest the break level.

Strategy is:

1) Weekly chart, draw main SR ranges

2) Every day chart – anticipate value to come back to these areas. Search for PA candles – Pin Bars and many others

3) 4hr for entries on 50% retraces, confirmed larger breaks, or retraces again to interrupt factors

4) Set SL at logical positions – usually final swing H or L

5) Transfer SL up (or down) to the brand new commerce SL level – this locks in income

6) Goal is identical for all trades – Measure the final transfer between S and R and take 90% as a goal

7) Enter a number of occasions – Every time I get my SL as much as the most recent commerce, I am locking in income. Most significantly my danger is remaining fixed.

8) For the very first commerce of a transfer, I solely danger half of my regular danger – it is because value can do something, and it could go in opposition to me

9) as soon as value strikes in my favour I enter at my regular danger stage

10) If I’ve a number of trades open and they’re in danger, the overall danger solely provides as much as my general danger stage

11) I cease buying and selling the run when reward to danger will get decrease than about 2 to 1

12) Typically I’ll enter on continuation candles in the course of the run – inside bars, pins, however I strive and hold it so simple as potential

I take advantage of a place calculator (from Babypips) to calculate lot sizes based mostly on SL place and my danger stage.

My danger I soak up $ and not a lot %. I can reside off $ however not % !

It is nothing new, nothing complicated. I am not reinventing the wheel. I am simply making use of primary value motion to enter a number of occasions on a run – that is the place you may get thousand of pips from a 500 to 800 pip run.

Usually the reward to danger for the early trades is round 8 or 10 to 1.

I began the thread as a result of I have been posting within the Rookies part to assist a couple of there – it is about time I introduced it collectively in 1 place! Much less complicated for this historic mind!

Now the boring bit: Been buying and selling for about 8 years. Initially shares/shares, then CFDs, then foreign exchange.

At all times used market makers – now I’ve dumped them and gone to ECN.

At all times used to commerce 1m, 5m, 15m charts with MACD, stochs, RSI and many others. Dumped them and went with value motion, no indicators, simply SR.

My method is predicated on assist and resistance being THE most vital factor on the charts. Equally as vital is danger mgt.

It really works for me and could also be helpful to some others. I do know PA merchants are most likely doing all these items already. For me it is a no brainer now – after dropping and dropping some extra, I took about 6 months out of the sport to rethink, analyse and study. Then about 2 years in the past I got here again to it with this method and it is working very properly.

UK Nationwide, Aussie Citizen, now residing in Thailand – the liberty is sweet!