High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” Forex

As mentioned and promised in FXCyborg’s essential thread (“High Stage Accuracy Methodology With Little To NO Draw-down”), the connected indicator identifies the 3-bar engulfing patterns which might be the core part of his excessive worthwhile methodology. This thread isn’t about discussing his methodology however as a substitute offering a great tool for shortly establish the patterns and thus potential ranges to commerce from.

So please restrict the discussions right here to the usage of the indicator solely, experiences utilizing it, attainable enhancements and sharing parameters which may be helpful for others to make use of. DO NOT USE THIS THREAD TO DISCUSS THE METHOD AT ALL – THAT SHOULD BE DONE IN THE MAIN THREAD. LIMIT THIS THREAD TO DISCUSSION ABOUT USING THE INDICATOR ONLY. SIMILARLY DON’T CLUTTER FXCYBORG’s MAIN THREAD UP WITH DISCUSSIONS ABOUT THIS INDICATOR THERE.

The indicator is parameterised and thus versatile in how it may be utilized. It may be utilized in a ‘strict’ mode that solely seems to be for excellent setups thus limiting the variety of patterns it identifies. Or utilized in a extra versatile mode in order that it picks up extra patterns, however the dealer then has extra to judge. Every to their very own how they wish to use it. There isn’t a proper manner. Ultimately it’s purely trying to figuring out potential 3-bar engulfing patterns for additional consideration if a commerce must be made or not when the pullback occurs. It’s as much as the person dealer, based mostly on the opposite guidelines and context as described by FXCyborg if the sample is at a degree to be traded or not.

The indicator isn’t an excuse to not use your mind!!! It’s a must to consider the context across the patterns and decide if a possible commerce exists or not.

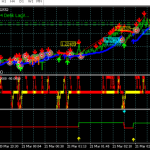

The pictures under are examples of it capturing all of the trades on varied time frames that FXCyborg made in his opening publish. I’ve been buying and selling for a few years and by no means thought-about dropping right down to the 1-min chart as I felt there was an excessive amount of noise. How fallacious I used to be.

Facet be aware: As I’ve been testing the indicator right now, I’m up simply over 5 % buying and selling simply off the 1-min chart (cross referencing towards larger time-frames after all). No manner close to at FXCyborg’s degree, however I’m simply beginning out and happy with the outcomes thus far High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” I nonetheless have a lot to study and absorb and that can include extra display time and finding out the principle thread. However I might personally prefer to thank FXCyborg for revealing this methodology. BIG MASSIVE THANK YOU High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert”

Indicator Parameters:

Beneath is an outline of the parameters utilized by the indicator to make it versatile.

BodyPercentageCheck, default = 70 %.

Make sure the physique of bars 1 and 2 are related in measurement. So, utilizing default the smallest physique have to be not less than 70 % of the bigger one. For instance, if one physique was 5 and the opposite 10 (50 %) it would not fulfil this standards if default of 70 was used.

M1_MinBody, default 2.0 pips for 1 minute timeframe (tf).

Ensures that the dimensions of the physique vary between the open of bar 1 and shut of bar 2 is a minimal pip measurement. (Observe: If ‘Discretionary Logic’ is turned on (see later parameter) then it makes use of the bottom low to the shut of bar 2). There may be one worth for every MT4 timeframe so M5_MinBody (5 min tf) to MN_MinBody (Month-to-month tf)

The thought is to filter out very small bull bar actions for bars 1 and 2. For instance, would we be interested by two small bull bars the place the physique vary was solely 2 pips on the M30 timeframe? In all probability not, as it’s an insignificant transfer even when there may be an engulfing bar subsequent. So, setting the minimal pip motion for every timeframe filters out these strikes which might be so small to not be worthy of consideration.

Observe: The default values supplied right here was me wanting significantly at EURUSD and captures all of FXCyborg’s instance trades on his opening publish (see photographs under). However after all, they may in all probability should be totally different for every foreign money pair as each day ranges range. After all, if you don’t need this filter making use of set the values to 0 for every of those xx_MinBody parameters and the physique vary won’t be checked in any respect when attempting to establish the 3-bar sample.

DiscretionaryLogic, default = true & DiscretionaryMultiplier, default = 1.33.

As folks have commented in the principle thread, there may be some discretion within the requirement for the our bodies of bars 1 and 2 been related in measurement significantly when the engulfing bar seems to be good. Even the examples within the opening publish by FXCyborg spotlight this. These parameters try to use that discretion and nonetheless spotlight potential 3-bar patterns even when the physique comparability verify isn’t fulfilled.

It does this by checking the physique measurement of the engulfing sample. Utilizing the default worth, if the engulfing physique is 1.33 occasions greater than the MinBody worth (see above) for the time frame it’ll spotlight the 3-bar sample regardless that the our bodies of bar 1 and 2 and never comparable in measurement.

So, in plain English what that is doing is that if we have now a great engulfing bar however the two bull bars earlier than it are usually not actually comparable in measurement (‘Physique Proportion Examine’ above) then the sample continues to be recognized. Intuitively this appears to make sense and with out one thing alongside these strains these discretionary alternatives wouldn’t be recognized. After all, if you need strict guidelines to be adopted concerning the bars 1 and 2 our bodies comparable in measurement swap it off by setting the worth to false.

IgnoreBigEngulfing, default=true.

FXCyborg talked about that the engulfing bar is to not engulf the our bodies of each the previous bars, simply the prior physique solely. This is applicable that filter.

PopupAlert, default-true & Notifications, default=false

Fairly self-explanatory. When a legitimate 3-bar sample is detected you’ve got the choice to ship an alert with an audible alarm. Makes use of the inbuilt Metatrader alerting system. Equally, you’ve got the choice to ship notifications to your Cell gadget utilizing the Metatrader inbuilt notification system.

Utilization

Blissful to make this indicator out there to the Foreign exchange Manufacturing unit group and distribute the item for private use solely. However please don’t ask for the MQL4 supply code I can’t be giving my exhausting work away for others to remodel. I am positive you perceive.

Different Feedback/Notes:

Please bear in mind that that is only a software and highlights all of the 3-bar patterns no matter location and different buying and selling context. Completely it doesn’t imply you commerce each sample, and you must apply the opposite standards that FXCyborg is kindly informing everybody about in the principle thread. It’s your duty to use widespread sense in utilizing this. Plus bear in mind, you’re NOT buying and selling the sign you’re buying and selling the pullback to the right degree.

I’ve not tried to optimise the parameters in anyway. It’s for everybody to experiment and give you what they personally really feel are good parameters in order to establish these patterns a dealer possibly interested by. However the supplied defaults appear to work fairly nicely with EURUSD not less than. It’s a commerce off between making issues too strict and never getting many indicators and having too many who muddle the charts. I counsel folks again take a look at this to their very own satisfaction and add a remark on this thread if they’ve discovered one thing which may be of worth for everybody. Please share and focus on what you discover. Plus after all the parameter units will little doubt range between present pairs that exhibit totally different volatility and each day ranges.

Assume that’s about it for now.

Hope you all discover it helpful. Take pleasure in High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” High Accuracy Trading Technique – “3 Pattern Bar Indicator + Alert” … and inexperienced pips to all