39 Daily Chart 3-Candle forex

FACTS

- The market TRENDS greater than it BENDS/REVERSES.

- Figuring out focused reversal factors Helps for Reversal or Continuation Choices.

- If I miss a powerful reversal I can at all times get in on a LOWER TIME FRAME REVERSAL or A REVERSAL REJECTION SETUP.

- We’ll take trades Primarily on H4, H12 & Daily Charts or in accordance with the Daily Chart development on decrease timeframes resembling H1. When you commerce on H1 take smaller revenue.

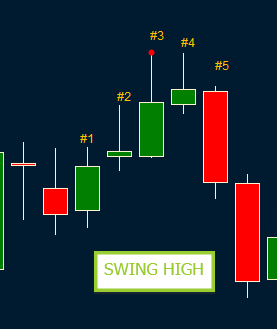

- The market reverses a development via a ‘U-Flip’ formation known as a SWING HIGH or SWING LOW.

- This method pre-emptively identifies the ‘TARGET’ reversal level to assist us commerce a REVERSE or CONTINUATION.

- 5 bars make up a Swing Excessive or Swing Low.

- At ALL instances BAR#3 is the “peak” bar.

- Eventualities #1 described beneath, are our supreme commerce.

Connected Picture

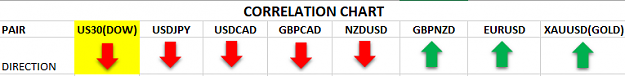

- EURUSD, NZDUSD, USDCAD, XAUUSD, USDJPY

- Newly Added GBPCAD, GBPNZD – nice assist with USDCAD & NZDUSD trades

- Crypto Pair LTCUSD – additionally nice for serving to with figuring out USD power

NB: I additionally watch the US30 and the USDX to get affirmation on USDJPY route, and common sentiment on the greenback. A great useful resource for extra info.

THE LONG(BUY) TRADE

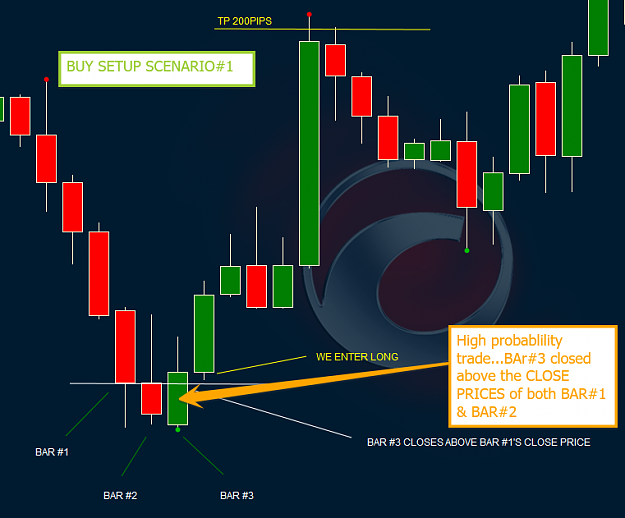

supreme BUY SCENARIO#1

- Market is tending downwards (at the least for 3 days). Downtrend – Creating decrease highs and decrease lows.

- The LAST BAR (BAR#3) closes with two bars having increased lows on its LEFT

- BAR#3 closes ABOVE the CLOSE PRICE OF BAR#1 (if BAR#1 has a BEARISH BODY) OR above the OPEN PRICE OF BAR#1 (if BAR#1 has a BULLISH BODY).

- Open a BUY TRADE OR BUY LIMIT at BAR#1’s OPEN (if BAR#1 has a bullish physique) or on the CLOSE (if BAR#1 has a BEARISH BODY)

- Cease ought to be positioned at 50 pips or 15 pips beneath BAR#2’s Low, whichever is bigger. If BAR#1 has a decrease low than BAR#2, we use BAR#1’s Low – 15pips for our cease.

- The typical Take Revenue is 100-200 PIPS. Swingers might maintain longer.

- Assess the Win Chance.

- The WIN likelihood is increased when BAR#3 closes ABOVE Each “the” BAR#1 & BAR#2 costs.

- The WIN likelihood is increased when BAR#3 closes ABOVE Each “the” BAR#1 & BAR#2 costs AND the BAR#1 and BAR#2 costs are near or on the identical stage.

- The above is essential as a result of rejection of reversals are widespread on the BAR#1 PRICE

OTHER BUY SCENARIOS

These will happen when BAR#4 OR BAR #5 shut ABOVE ‘the’ BAR#1 & BAR#2 Costs. The identical guidelines apply for taking the commerce as outlined in BUY Situation#1

THE SHORT(SELL) TRADE

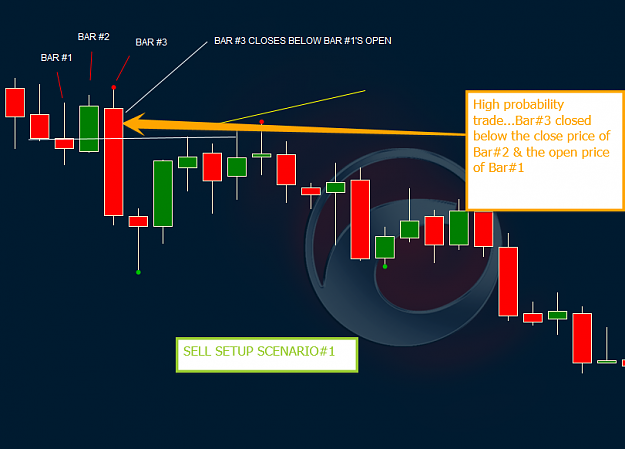

supreme SELL SCENARIO#1

Market is tending upwards (at the least for 3 days).Updevelopment – Creating Larger highs and better lows.

The LAST BAR (BAR#3) closes with two bars having decrease excessive on its LEFT

BAR#3 closes beneath the CLOSE PRICE OF BAR#1 (if BAR#1 has a BULLISH BODY) OR beneath the OPEN PRICE OF BAR#1 (if BAR#1 has a BEARISH BODY).

Open a SELL TRADE OR SELL LIMIT at BAR#1’s OPEN (if BAR#1 has a BEARISH BODY) or on the CLOSE (if BAR#1 has a BULLISH BODY)

Cease ought to be positioned at 50 pips or 15 pips above BAR#2’s excessive, whichever is bigger. If BAR#1 has a better excessive than BAR#2, we use BAR#1’s Excessive + 15pips for our cease.

The typical Take Revenue is 100-200 PIPS. Swingers might maintain longer.

Assess the Win Chance.

The WIN likelihood is increased when BAR#3 closes BELOW Each “the” BAR#1 & BAR#2 costs.

The WIN likelihood is increased when BAR#3 closes BELOW Each “the” BAR#1 & BAR#2 costs AND the BAR#1 and BAR#2 costs are near or on the identical stage.

The above is essential as a result of rejection of reversals are widespread on the BAR#1 PRICE

Connected Picture (click on to enlarge)

Daily Chart 3-Candle

OTHER SELL SCENARIOS

These will happen when BAR#4 OR BAR #5 shut BELOW ‘the’ BAR#1 & BAR#2 Costs. The identical guidelines apply for taking the commerce as outlined in SELL Situation#1

BUYING & SELLING REJECTION LEVELS

These are essential to take a look at as a result of the primary signal BUYERS are exhausted is that there’s resistance towards each alternative to proceed to increased costs and the primary signal that SELLERS are exhausted is that there’s resistance towards each alternative to drive costs decrease.

The place do we discover these ranges?

Shopping for Rejection ranges are discovered on the HIGHEST BULLISH CLOSE PRICE of a Swing Low.

Promoting Rejection ranges are discovered on the LOWEST BEARISH CLOSE PRICE of a Swing excessive.

NOTES & TIPS

Maintain Take Revenue at 100 pips for counter development setups.

If worth is failing at bar #1’s worth, the development will proceed.

In case you are in a brief/promote commerce and worth retains failing (not in a position to shut beneath) on the shut worth of the Lowest Bearish Shut Worth of the Swing Excessive Construction, the market may very well be trying to go bullish, defend your commerce or take income. In any other case, stronger promoting forward.

In case you are in an extended/purchase commerce and worth retains failing (not in a position to shut above) on the shut worth of the Highest Bullish Shut Worth of the Swing Low Construction, the market may very well be trying to go bearish, defend your commerce or take income. In any other case, stronger shopping for forward.